When it comes to trading in the forex market, there are various strategies that traders use to profit from price movements. Two of the most popular styles are day trading and swing trading. Each approach has its unique advantages and challenges, and the best choice depends on your personal preferences, time availability, and risk tolerance. In this article, we’ll explore the differences between day trading and swing trading to help you determine which style suits you best.

What is Day Trading?

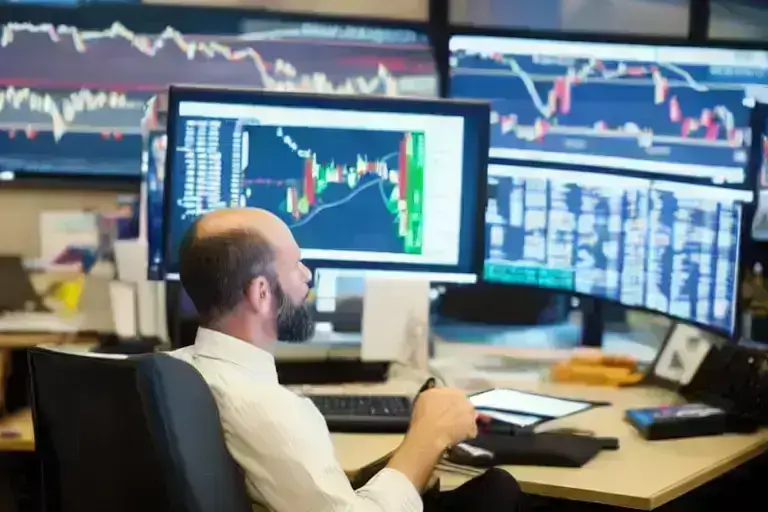

Day trading involves buying and selling currency pairs within the same trading day, often making multiple trades throughout the day. The goal is to capitalize on short-term price fluctuations, and positions are typically closed before the market closes to avoid overnight risks. Day traders rely heavily on technical analysis and short-term charts to make quick decisions.

Pros of Day Trading

- Quick Results: Since trades are closed within a day, you can see immediate results and potentially make profits quickly.

- No Overnight Risk: By closing all positions before the end of the trading day, day traders avoid overnight exposure to market risks.

- Active Trading: Day traders enjoy fast-paced environments, with constant opportunities for profit.

Cons of Day Trading

- Time-Intensive: Day trading requires a lot of time and attention, as traders need to monitor the markets throughout the day.

- High Stress: The fast nature of day trading can be stressful, especially when trades don’t go as planned.

- Transaction Costs: With more trades, the cost of commissions or spreads can add up, potentially eating into profits.

What is Swing Trading?

Swing trading, on the other hand, involves holding positions for several days or even weeks to capitalize on medium-term price movements. Swing traders typically focus on capturing the “swings” in the market, using a combination of technical and fundamental analysis to identify potential entry and exit points.

Pros of Swing Trading

- Less Time-Intensive: Unlike day traders, swing traders don’t need to monitor the markets constantly, making it suitable for those with other commitments or limited time.

- Larger Profit Potential: By holding positions for several days, swing traders can capture more significant price moves and potentially earn higher profits.

- More Flexibility: Swing traders can take a more relaxed approach compared to the fast-paced demands of day trading.

Cons of Swing Trading

- Exposure to Overnight Risk: Since positions are held for several days, swing traders are exposed to overnight market risks.

- Slower Results: It takes longer to realize profits in swing trading, which may not appeal to those seeking quick returns.

- Requires Patience: Swing trading involves a slower decision-making process, and traders must be patient as they wait for the market to move in their favor.

Which Style Suits You?

Deciding between day trading and swing trading depends on several factors:

- Time Commitment: If you have the time to dedicate to actively monitor the markets throughout the day, day trading might suit you. If you prefer a more flexible approach that doesn’t require constant attention, swing trading may be a better fit.

- Risk Tolerance: Day trading allows you to avoid overnight risks, but the fast-paced nature can be stressful. Swing trading exposes you to overnight market risks but offers a more relaxed approach.

- Personality: If you thrive in a high-pressure, fast-moving environment, day trading may be the right choice. Conversely, if you prefer a more patient, long-term approach, swing trading could align better with your personality and goals.

Both day trading and swing trading offer unique benefits, and choosing between the two depends on your preferences, available time, and risk tolerance. While day trading offers quick results and the excitement of constant action, swing trading allows for larger potential profits and a more relaxed trading style.

For more resources and tips on forex trading, visit IamForexTrader.

By understanding the differences between these two strategies, you can select the one that aligns best with your lifestyle and trading goals. Whether you’re interested in fast-paced action or a more patient approach, both day trading and swing trading offer valuable opportunities in the forex market.