This Ally Invest review will give you the lowdown on this web-based trading platform. The company claims to offer commission-free trades, a mobile app, and robo portfolios. But, is it really all that it’s cracked up to be? And, most importantly, can it live up to its claims? We’ll discuss that and much more in this Ally Invest review. So, what do you need to know before you decide to sign up with Ally?

Ally Invest is a web-based trading platform

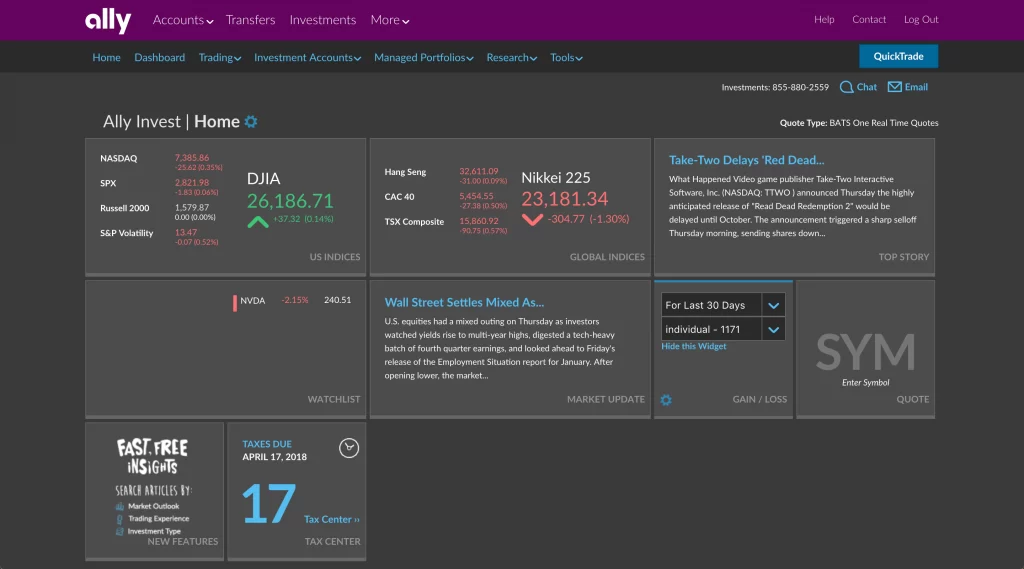

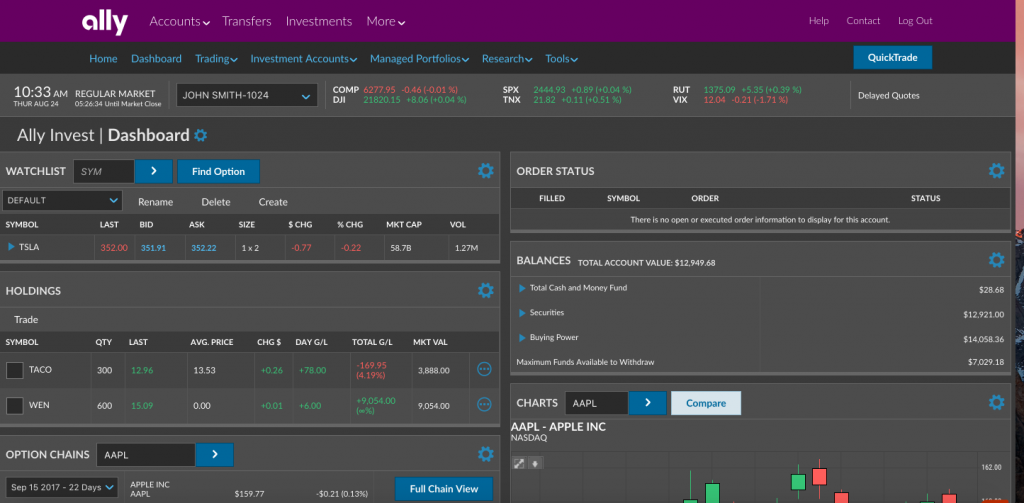

The homepage of Ally Invest includes a link to the Ally Invest Live platform, which provides streaming quotes and more modern website functionality. The primary website works well, has a logical UI, and provides many tools for market research. Its Strategy Workbench feature is especially useful for options traders because it allows you to view current holdings and potential trades as well as changes in risk. The Probability Calculator provides more research options for options trading, and even lets you adjust the implied volatility of at-money options.

While there are a few downsides to Ally Invest, this service is highly customizable and focuses on the average investor. The platform is designed to provide insight to non-savvy investors, and the platform includes a community area for its users. The site also offers commission-free trading of stocks and ETFs, as well as bonds, mutual funds, and options. Users can also trade on the Oanda Compare Money Exchange market, but this is a separate account.

It offers commission-free trades

It offers commission-free trades on stocks and ETFs. In addition to not charging any commissions, Robinhood also has free market news and apps. You can also choose to receive premium features, such as Nasdaq level two data, for $10 a month. Robinhood is one of the most popular investment apps, with over four million customers in the U.S. and six million worldwide. There are some cons, however.

First, it has a low minimum deposit. The second biggest draw is its low minimum balance. The web-based trading platform doesn’t have a minimum account balance requirement, which means that you can invest with as little as $1. You can even invest fractional shares. The trading platform has learning articles that can help you get started with stock trading. However, if you’re new to trading, there is no need to worry. It offers commission-free trades on stocks and ETFs and no minimum account balance.

It offers a mobile app

Ally Invest is a full-featured broker. Customers can open a standard taxable brokerage account, joint accounts with other owners, and retirement accounts. You can even set up custodial accounts for children. The company is highly rated by investors for its robo-advisory service. Whether you’re looking for a new investment strategy or just want to monitor your investments from your mobile phone, https://usforexbrokers.com/reviews/ally-invest/ has the tools you need.

Ally Invest collects your IP address and mobile device identifiers. Most sites collect timestamps and dates of logins. In some cases, Ally Invest uses your mobile phone’s GPS to log your geolocation. You can also set up tracking cookies, which store all kinds of data. They may store your Internet Service Provider and device ID, as well as the date and time you accessed the site.

It offers robo portfolios

Ally Invest has several different types of robo-advisory services. Its Cash-Enhanced Robo Portfolio is free from advisory fees and features automatic rebalancing, so you can avoid manually maintaining your portfolio allocations. It also supports multiple account types, including traditional and Roth IRAs. Ally Invest also supports socially responsible investing by supporting companies and industries that adhere to ethical standards. You can customize your portfolio to your liking with some of the tools and features offered by Ally Invest, including low account minimums.

Ally Invest Robo Portfolios are composed of exchange-traded funds, which cover 17 asset classes. They also include a 30% cash account that earns the same interest as an Ally Online Savings account. The cash balance acts as a buffer against risk and cannot be accessed like a tradition